K-STEP UP: Kansas Statewide Teacher Education Pathway for Underserved and Place-bound

Funded by a Teacher Quality Partnership Grant from the United States Department of Education, K-STEP UP, an acronym for Kansas Statewide Teacher Education Pathway for Underserved and Place-bound, is a program that provides a pathway for students in Kansas City and Liberal who want to become teachers and who intend to remain in their home community. The program creates a seamless education path that starts in high school and culminates with support during the graduates' first two years in the classroom. The program runs from Spring 2019 to Fall 2022.

"This program opens the doors of opportunity – from one side of Kansas to the other – and prepares teachers who reflect the children in their communities."

The KSU Site-Based Program: K-STEP UP

The site-based program allows for 60 future teachers, half in Liberal and half in Kansas City, to earn associate's degrees at their local community colleges and complete their education degrees online through K-State. The program targets underserved populations, individuals who want to teach in rural areas. While still in high school, participants will attend K-State's successful weeklong immersive camp, the Kansas Advanced Teacher Academy (KATA).

K-STEP UP provides multiple entry points for future teachers. They can access the program by joining their high school's teaching career pathway program, taking classes at Kansas City Kansas Community College or Seward County Community College, or enrolling in K-State's online elementary education degree program.

Future teachers in K-STEP UP will complete site-based, one-year clinical residencies followed by a two-year induction as they begin their teaching career.

Financing your degree through K-Step UP

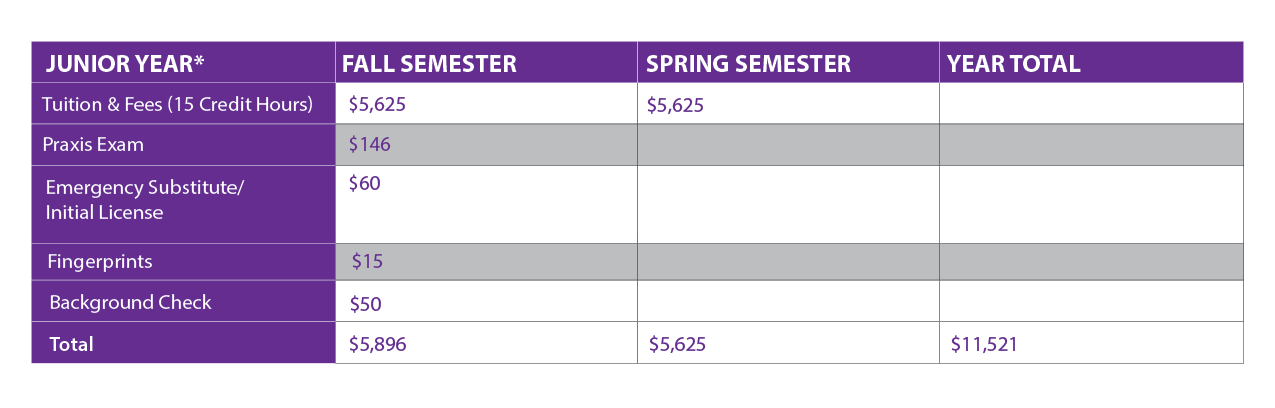

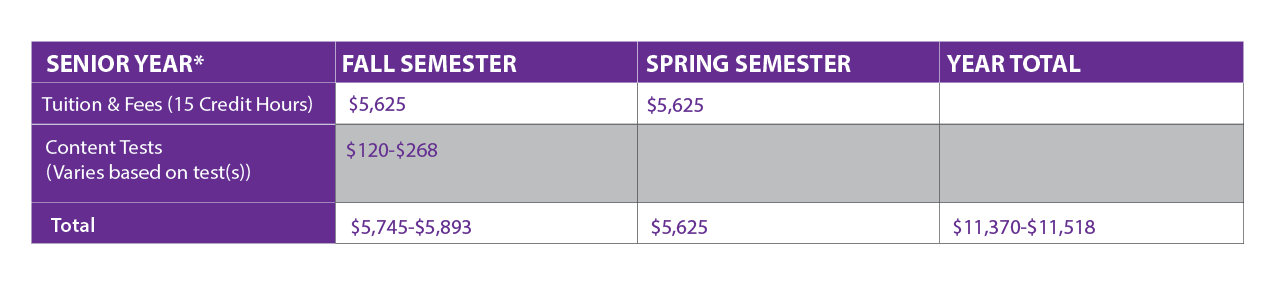

Below are the current costs associated with completing the final two years of Kansas State University’s Elementary Education Degree online, through the K-STEP UP program.

*Costs are subject to change

Figuring out how to pay for college can be a stressful, and often times, a confusing task. Below are a few of the most common methods students utilize to offset college expenses:

Federal Student Aid (https://studentaid.gov)

- Loans – Money you borrow to pay for college or career school; you must repay your loans and the interest that accrues

- Grants – Financial aid that's typically based on need and doesn't typically have to be repaid

- Work-Study – Working on campus to earn money to help you pay for school

Scholarships are a key strategy to offset college expenses. Scholarships can be based on academics, leadership, financial need, and a host of other factors. Unlike student loans, scholarship money does not need to be paid back. To view scholarships available at Kansas State University, visit https://www.k-state.edu/sfa/scholarships-aid/scholarships/ To view scholarships through the State of Kansas, visit https://www.kansasregents.org/scholarships_and_grants.

Part-time employment is always an option to offset college expenses. Balancing academics and employment expectations is always a delicate balance. We recommend finding a position in the industry in which you want to serve as a professional. Future teachers should consider working in the schools as para-professionals, after school programs, or other school-related positions.

Paying for College – Student Scenarios

The following student scenarios are based on one academic year (two semesters) of college completed remotely, and taking 15 credit hours (or approximately 4-5 classes) per semester. Students are actual current or former College of Education students. The scenario’s are fictional to them but representative of common financial situations.

Tori is a graduate of academically strong school with a great academic record. She also held many leadership positions in college and is an active community volunteer. Both of her parents are considered upper middle class and have strong incomes, this allowed her flexibility when paying for school.

It costs $11,521 for her to attend school for one school year. Her family contribution of $3,521 minimizes it to $8,000 that she must figure out how to pay each year that she attends her school. With her $1,000 K-State Online Education Scholarship, and her outside scholarships of $4,000 for her community, service, and leadership roles, all that is left to pay is $3,000. She can either decide to pay the $3,000 on her own by working or take out a Federal Student loan each year to pay the difference.

- Graduate of KCKCC

- Strong academic record

- Held leadership positions in college

- Active community volunteer

- Both parents are employed with strong incomes – considered upper middle class

| Cost of Attendance for the academic school year: | $11,521 |

| Tori’s Financial Aid Package: | |

| Expected family contribution | $3,521 |

| K-State Online Education Scholarship |

$1,000 |

| Outside Scholarships (Community, Service, Leadership, etc.) |

$4,000 |

| Federal Student Loan |

$3,000 |

| Total |

$11,521 |

Ricky is a graduate of SCCC with a more average academic record. With his mother being a single mother, raising three children, and working, he did not have as much time as others to focus extensively on school because he helped with household expenses by working while also attending school.

Ricky is a graduate of SCCC with a more average academic record. With his mother being a single mother, raising three children, and working, he did not have as much time as others to focus extensively on school because he helped with household expenses by working while also attending school.

His cost of attendance each year for school is $11,521. He does not expect any family contribution, because he lives in a single parent household, his mother only works part-time, and does not have any money saved up. He received the Federal Pell Grant of $6,000 to cover half of his tuition. He also received a Supplement Education Opportunity Grant for $1,249, a Kansas Comprehensive Grant for $500, and a TEACH Grant for $3,772 which will cover his entire tuition. Any extra fees he will cover by working through college.

- Graduate of SCCC

- Average academic records

- Worked through high school to help with household expenses

- Single mother household and one of three kids

- Mother works part-time and has not saved any money

| Cost of attendance for the academic school year: | $11,521 |

| Ricky’s Financial Aid Package: | |

| Expected family contribution | $0 |

| Federal Pell Grant | $6,000 |

| Supplemental Educational Opportunity Grant | $1,249 |

| Kansas Comprehensive Grant | $500 |

| TEACH Grant | $3,772 |

| Total | $11,521 |

The following scenario follows a student who is taking classes part time due to family and/or work obligations. Rather than look at a yearly total, this scenario uses the cost per credit hour of school.

- Graduate of KCKCC

- Works part-time as a paraeducator.

- Mikayla does not want to take out student loans for school so she must come up with a plan to cover tuition and fees. Her plan is to apply for scholarships, submit the FAFSA form to see if she’s eligible for grant money, and then work to make up the difference.

| Mikayla’s Financial Aid Package: | |

| Community Scholarship | $1,000 |

| Federal Pell Grant | $1,000 |

| Federal Student Loan | $6,000 |

| Total | $2,000 |

Mikayla receives a small community scholarship and a federal grant. She was also awarded a student loan but does not accept it as she doesn’t want to take out student loans to go to school. Mikayla knows that it will cost $375 per credit hour and that most classes are 3 credit hours. That means, that she needs to have $1,125 for each class she enrolls in. (6 credit hours = $2,250, 9 credit hours = $3,375)

Mikayla realizes that she will need to work to cover the difference between the cost of 9 credit hours ($3,375) and the financial aid that she has received ($2,000). She realizes that if she works 30 hours per week and makes $14 per hour, she can cover approximately $1600 per month. Therefore, in one month, she can cover the outstanding balance of taking 9 credit hours. Mikayla decides that, although it will take longer, she will continue to work part-time and go to school part-time to avoid taking out student loans.

Note: that students must be enrolled at least half-time (6 hours) to be eligible for federal student aid.

*Students are actual current or former College of Education students. The scenario’s are fictional to them but representative of common financial situations.